Welcome to Financial Advice for the Property Tribes community

Working with Property Tribes, our team of professional, qualified and Chartered Financial Advisers provide authorised financial advice and solutions, from the simplest of cases to the most complex of financial planning solutions.

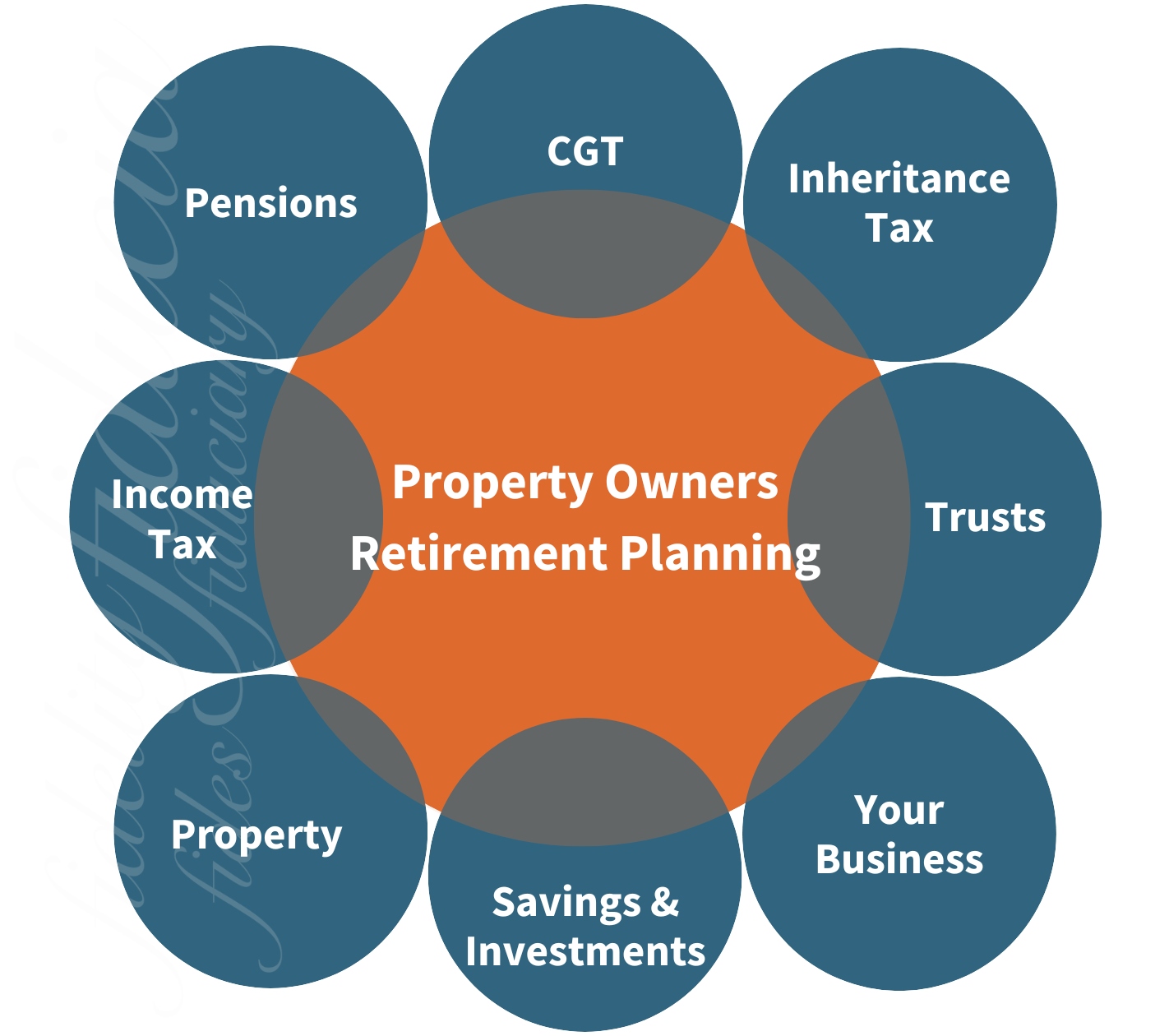

At Fiducia Wealth Management, our mission as Chartered Financial Planners is simple, to empower property investors like you to maximise your rental income and build substantial wealth through real estate.

As specialist wealth advisers to landlords across the UK, we understand the tax implications involved with managing an investment property portfolio.

Whether you are just starting out with your first buy-to-let or have accumulated numerous rental properties over the years, we can help property investors minimise taxes on their rental income and capital gains when selling.

Additionally, we can advise you on using pension and inheritance tax strategies tailored for landlords to efficiently pass on your portfolio while navigating Inheritance Tax for your loved ones in the future.

For high-net-worth property investors, there are innovative Trust structures we can help establish to protect the assets funding your lifestyle.

We invite investors who are focused on expanding their property portfolio to schedule a free consultation with us.

As members of Property Tribes, we aim to provide landlords with the tax and wealth management expertise needed to accelerate portfolio growth. By working together, we can ensure your well-earned rental income and capital gains are protected.

Contact us today on 01206 321 045 or click the button below to email us and start discovering how our specialist knowledge can help you maximise your long-term wealth.

Your pension is a powerful vehicle for tax-efficient property investing that many landlords overlook.

Contributing even a portion of your rental income into pensions can net substantial tax relief while accelerating your retirement investing. We can advise landlords on strategies like:

- Making additional pension contributions to offset rental income – this minimises income tax while building your nest egg

- Using your pension to purchase property via self-administered schemes – this allows tax-free capital growth within your pension

- Drawing rental income from properties held in your pension in retirement – an efficient way to boost retirement cash flow

- Passing your pension-held property portfolio onto loved ones free of inheritance tax

- Making additional pension contributions to offset rental income – your pension contribution is boosted by tax relief and, if you’re a higher rate taxpayer, you receive a tax reduction, or tax rebate, from HMRC as well

- A pension fund can provide much needed liquidity to compliment your property portfolio in retirement

- Using your pension to purchase commercial property via self-administered schemes – this allows tax-free capital growth and tax-free rental income within your pension

- Drawing rental income from properties owned by your pension in retirement – you can review the level of withdrawals to avoid higher rate tax

- Passing your pension-owned property portfolio onto loved ones free of inheritance tax

As specialist property investor advisers, we can ensure your pension compliments your property portfolio and, where suitable to do so, it can even own some of it.

Call us on 01206 321 045 or complete the form below to book a free consultation today to discover prudent pension planning for your property activities.

For higher net worth property investors, inheritance tax is a key consideration when transferring wealth.

If handled improperly, your loved ones may face a hefty 40% tax on your estate that erodes assets built through years of rental income.

Proactive IHT planning we offer landlords includes:

- Reducing your inheritance tax liability by planning ahead

- Utilising the cessation of capital gains upon death to distribute property to loved ones

- Utilising trusts to protect property assets.

By planning ahead now, you can legitimately avoid unnecessary tax for beneficiaries in the future.

Call us on 01206 321 045 or complete the form below and start discussing prudent IHT planning tailored for your property portfolio.

For property investors, capital gains tax on the sale of rental properties and other assets can also diminish portfolio growth long-term if not properly managed.

As your specialist advisers, Fiducia guides clients on planning strategies such as:

- Timing disposals to make maximum use of the annual CGT exemption

- Exploring UK property CGT reliefs that you may qualify for

- Utilising losses to offset gains where possible

- Transferring assets to your spouse to make use of their allowance

- Deferring capital gains tax with investment into SEIS or EIS schemes

The key is ensuring you consider CGT early when making major sale or transfer decisions. By working together, we can prudently minimize capital gains tax events over time.

Call us on 01206 321 045 or complete the form below and start the discussion on how you can navigate your way through any unnecessary CGT liability.

Managing a property portfolio often involves significant tax implications that can erode your hard-earned rental income if not handled correctly.

We specialise in helping landlords utilise allowable deductions and optimise their tax positions, including:

- Claiming all permissible expenses like agent fees, repairs, mortgage interest, etc

- Considering whether property ownership between spouses should be amended to maximise personal tax allowances and basic rate tax bands

- Utilising tax reliefs generated by pension contributions, or tax reducers such as investing and reinvesting into VCTs

Don’t let overlooked rental tax planning undermine your returns.

Call us on 01206 321 045 or complete the form below and book a landlord tax planning session today so we can help you keep more of your income.

For landlords focused on wealth preservation and portfolio continuity, Trust structures warrant consideration.

Assets placed into trusts can help mitigate inheritance tax, protect assets from outside claims, avoid probate delays, and provide control over distributions to beneficiaries.

Key areas where we can advise include:

- Using bare trusts or interest in possession trusts to gift property to heirs

- Establishing discounted gift plans into trust for effective IHT reduction

- Exploring names or nominated trust options for passing rental portfolio

- Structuring trusts for optimal control and family protection

- Using discretionary trusts or interest in possession trusts to gift property to heirs

- Establishing discounted gift trusts for effective IHT reduction whilst retaining an “income”

- Ensuring that inherited property remains within your bloodline

- Protecting your property from the death, divorce or bankruptcy of your children

As leading advisers for property investors, Fiducia can ensure Trusts you establish fit seamlessly within your broader plans.

Call us on 01206 321 045 or complete the form below and let's identify together if your Trust is fit or right for you